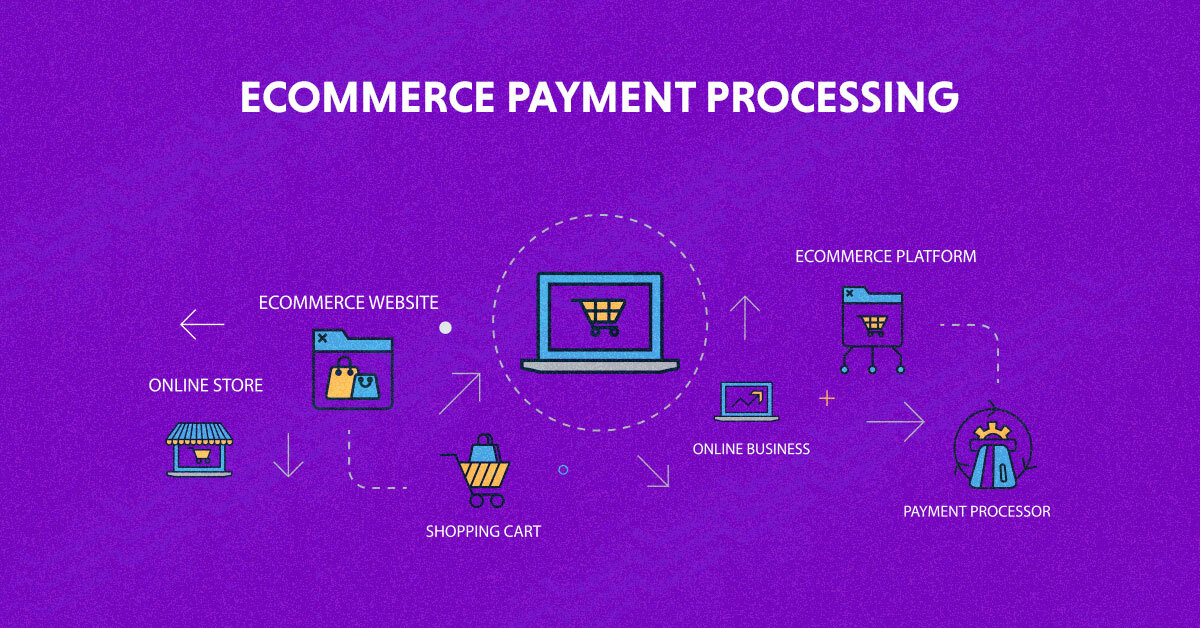

The eCommerce payment processor acts as a link between the bank and the merchant. Because it approves transactions, it has a significant impact on a merchant’s business; There will be no successful payment unless they give their go-ahead. A number of steps must be completed before the customers’ funds are deposited into the business merchant’s account.

The customer’s method of payment is validated as a result of this procedure. A checklist is run by the payment processor to make sure the customer can make the transaction work; These are:

Checks the customer’s balance with the bank; determines whether there are sufficient funds to complete the transaction; determines whether their credit card is valid when swiped at a credit card terminal.

An integrated online payment service into the eCommerce platform allows customers to pay for their online purchases. Merchants benefit greatly from the protection provided by payment gateways against hackers and con artists. Shape Security found that in 2018, about 90% of all login attempts on the websites of online retailers were legitimate attempts at hacking.

What are the Main Purposes of the Payment Processor?

Provides merchants with the equipment necessary to accept card-based transactions, facilitates the creation of a merchant account on your own or in conjunction with a third-party merchant service provider, and transmits the payment data between the merchant’s bank and the customer’s bank. the arc that talks to your bank. The customer’s payment information is directly charged through a connection between the merchant account and the store’s gateway.

Once all of the boxes have been checked, the processor will authorize the payment, making the direct debit translation successful. In addition, an eCommerce payment processor takes care of the merchant’s security by ensuring the validity of the transaction and compliance with PCI regulations.

It’s as easy as clicking a button to pay when a customer is ready to finish their order and complete the transaction. The payment processor is busy on the backend completing a number of steps to promptly verify the transaction. The checkout procedure includes the following steps:

Step 1: When paying for a product or service, the customer enters the information for their credit or debit card.

Step 2: The customer’s information is encrypted by the payment gateway before being sent to the payment processor.

Step 3: The payment processor is diligently examining the customer’s entered information to determine whether there are sufficient funds for the payment and whether the credit/debit card number is valid. The customer’s payment is either rejected or accepted by the payment processor based on the information gathered.

Step 4: The payment gateway receives approval from the payment processor if the payment is accepted. The merchant can then check the payment’s success on their website’s backend.

Step 5: After that, the funds are deposited into the merchant’s account. The deal has now come to an end.

The payment processor must complete this lengthy task, but the entire online payment processing procedure takes only a few seconds. Because it is the easiest and most secure method for conducting online transactions, the eCommerce payment processor has evolved into a safe haven for businesses.

Solutions for Best Ecommerce Payment Processor: The Payment Card Industry (PCI) is a non-profit global standards organization devoted to fostering credit card acceptance and fostering trust in commerce. The PCI oversees the monetary sponsorship of the installment card information security and decides how much assurance is required for the dealer.

Since payment card companies typically have specific guidelines for how merchants should handle customers’ credit card information, it is recommended that businesses either purchase or create a PCI-compliant credit card form.

Tokenization

Some payment processors use a “card hash,” which is not the same as the customer’s credit or debit card number, but rather than the customer’s credit or debit card information. By employing “tokenization,” the Payment Card Industry (PCI) ensures the safety of the credit and debit card information of its customers.

Tokenization occurs when the payment processor only examines a single number. As a result, both the merchant and the payment processor are unaware of the customer’s credit card number.

Fees

The kinds of fees will change depending on the provider. When a merchant uses an eCommerce payment solution, they are required to charge three specific fees: transaction fees, set-up fees, and monthly fees. A membership fee may also be required by some providers.

It is recommended that you establish your budget and your anticipated sales revenue in order to select the best eCommerce solution for your company. Merchants can save money in the future and avoid overspending thanks to this.

It is essential to be aware of the development of online payment methods and to know which features are essential to effective payment options. It is essential to be well-versed in eCommerce payment processing because payments are an essential component of your success as business owners, regardless of whether your company is just starting out or is already established.

quest dental

quest dental

quest dental

quest dental

quest dental

quest dental

quest dental

quest dental

quest dental

quest dental

quest dental

quest dental