Khwezi Trade is a South African online brokerage organization. If you are looking for a reliable Khwezi trade broker, local or international, obtaining a complete list of trustworthy credible sources can be challenging. The following is a comprehensive analysis of Khwezi Trade to assist you in making an informed decision before opening an account or trading on their platform.

A wide range of market products, including forex, commodities, financials, and shares, can be traded on an electronic trading platform provided by foreign exchange companies such as Khwezi Trade. The broker acts on the trader’s behalf and completes the deal. Khwezi Trade is an STP broker specializing in forex, metals, indices, commodities, and energies. This means that all trades are executed quickly and seamlessly.

Global financial institutions utilize STP to handle ultra-fast orders for financial transactions. This is accomplished by processing transactions automatically, a method known as “straight-through.” Tight spreads, large leverage ratios, and inexpensive fees are just a few of the benefits traders can enjoy while trading with this firm. Khwezi Trade brokers are drawn to the firm’s focused customer support services, swift order execution, and a wide range of account options.

Cost and Fees, Commissions and Spreads:-

Forex brokers generate money by charging traders commissions or spreads for each deal they facilitate. Trading instruments and account types influence the number of commissions a trader pays the Khwezi trade broker. What the trader gets for selling is known as a spread, and what the trader gets for buying is known as a spread (what the trader pays for buying). Depending on the market and factors like interest rate changes, variable or fixed spreads might be used.

Brokers may charge overnight open positions rollovers, commonly known as swap fees. These fees are calculated based on the interest rate differential between open positions in currency pairs. The Khwezi trade broker indeed charges a fee for trading CFDs. Commodities and indices CFDs are charged 3 ZAR commissions for each trade. Depending on the instrument and account type, charges can be different. The firm’s tight spreads are based on the account’s value.

Leverage: –

As the term implies, leverage refers to the amount of money that a Khwezi trade broker makes available to a trader to help them potentially raise their capital. With the power of 1:100, if a trader has 500 EUR in their account, they may handle a sum of 50 000 EUR. Traders should be mindful of the hazards associated with leverage, even though it is an excellent opportunity to raise their funds. Khwezi Trade’s standard leverage ratios are 1:200 for all account categories.

It’s a desktop trading platform:-

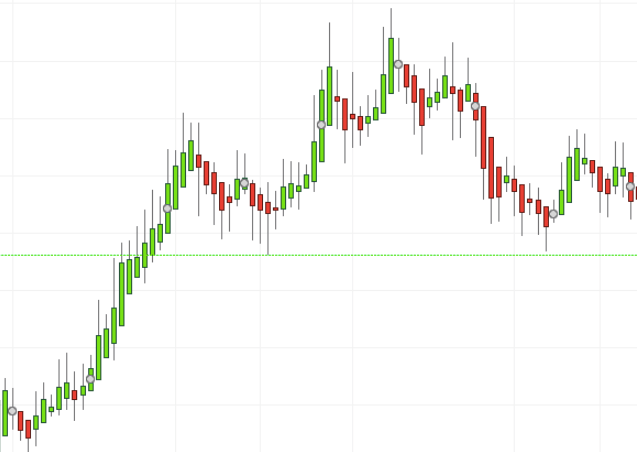

The MT4 desktop trading platform has four pending options: Buy Stop, Sell Stop, Buy Limit, and Sell Limit. These pending orders are the most basic and significant pending orders you will find in any Khwezi trade broker trading platform. A two-step login process would have been excellent, but it’s not available. If you rely solely on the initial login process, your finances and personal information are at risk. Scalping and Hedging and Expert Advisors can still be done on the desktop trading platform, despite the setback (EAs). To get Khwezi trade broker notifications on your computer, you must download the Khwezi Trade desktop trading platform. To be alerted to price changes that you specify, you can enable this feature in your MT4 account.

Pros:

- The app is compatible with both Mac and Windows computers.

- Several languages are supported.

- Many customizable indicators and tools can be found.

- Quick and Efficient Order Execution

- It is possible to hedge and scalp

- Price notifications and alerts

- Designed for ease of use by everyone

Cons:

- There is no need for a two-step login.

- The following are the most basic pending orders.