If you’re in the market for a personal loan, it may help to know how much your monthly EMIs will be before applying for one. HDFC Bank has a convenient online personal loan calculator that you can use to plan your repayment and disbursal schedule. The calculator can be found on the HDFC home loan page under the ‘EMI Calculator’ tab. To apply for a loan, click the ‘Apply Now’ button.

EMI calculator

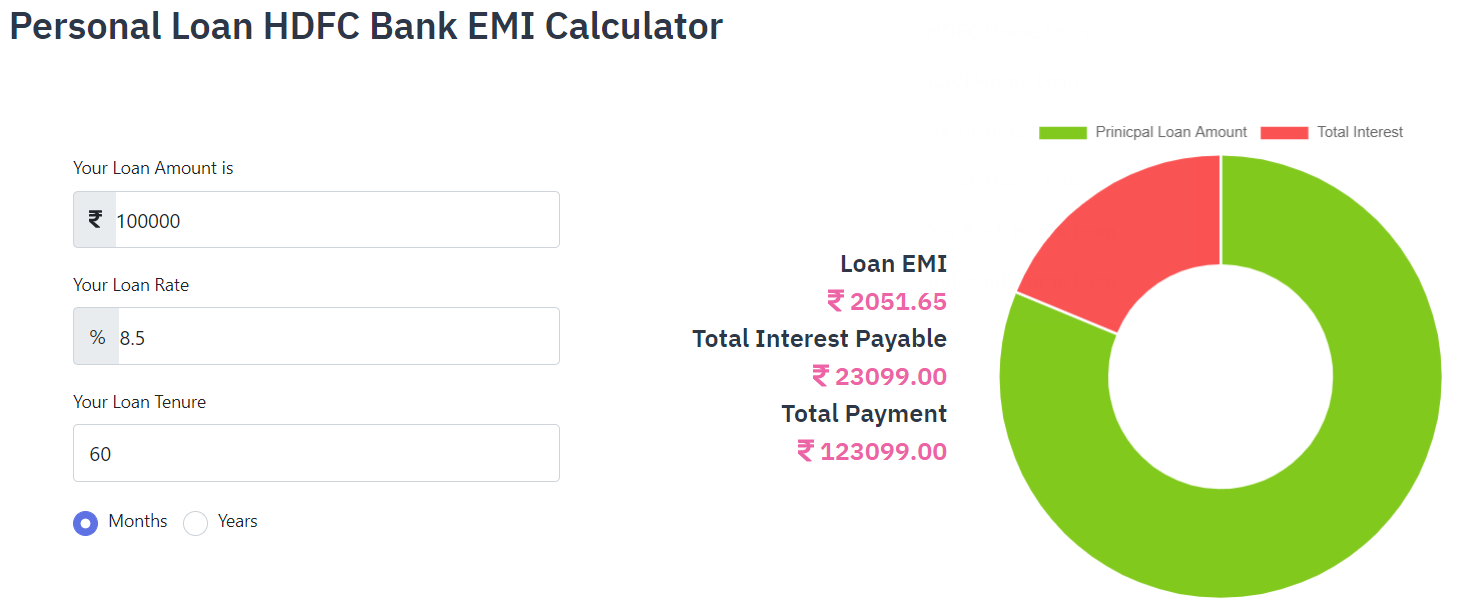

If you are looking for a personal loan, you may be wondering how to calculate your EMI. With an HDFC personal loan EMI calculator, you can find out how much you can expect to pay over time, as well as what your repayment options are. This calculator can also help you negotiate your interest rate with the loan provider.

A personal loan EMI calculator is an excellent way to manage monthly payments. It will show you how much money you’ll need to borrow, and if you’re eligible for a lower EMI. The EMI amount does not include any taxes or other charges.

Loan tenure

Personal loan tenure calculators are a great tool to help you determine your repayment terms. They will help you figure out the monthly repayments for different loans and compare the EMIs of various lenders. By entering your loan amount, interest rate, and tenure, you can determine which loan is right for you.

The HDFC personal loan tenure calculator will help you find the right loan tenure for your needs. You can choose a tenure of 12 months or up to 60 months. The shorter the term, the lower your monthly payment will be. Make sure that the duration you choose is within your affordability range.

Loan amount

The HDFC Personal loan calculator is a great tool that can help you figure out how much your monthly EMIs will be. The calculator requires a few details, including the loan amount, interest rate and tenure. Once you have these details, the calculator will automatically calculate your EMI. The calculator also helps you compare the EMIs of different interest rates and repayment tenures.

The calculator calculates the monthly payment based on your age and income. This will help you determine whether your loan is affordable for you. If you have a high income, you may be able to qualify for a lower loan amount.

EMI payable in less than a minute

EMI stands for Equated Monthly Installment. It is a set monthly payment that you make to your lender on a fixed date each month. It is a great way to save money by planning the payment in advance. It will also help you improve your credit score, since making timely payments on time can reduce the overall interest rate.

If you are worried that you may miss an EMI, you can contact your lender prior to the due date. Explain your financial situation and ask the lender to reduce the amount. Most lenders will grant such requests.

Transparency

An HDFC Personal loan calculator is a useful tool for borrowers to determine the amount of loan that they can obtain. They can input the amount of loan that they need, the tenure of the loan, and the interest rate. They can also choose the processing fee and prepayment option. After entering these details, the calculator will calculate the total amount that must be paid and the amortization schedule.

The HDFC bank personal loan calculator calculates the monthly instalments that need to be repaid. This information helps the customer decide whether this loan is affordable and what the monthly repayments will be. It will also show the total amount of interest that will be paid and how long it will take to repay the loan.

Benefits

HDFC personal loan offers a variety of benefits to customers and is available at competitive interest rates. This bank offers online loan application, online customer support and a click to talk facility to help you get the loan you need. There are several eligibility requirements, but if you meet the criteria, you can expect to have the funds in your bank account within two business days.

Your income is an important factor when it comes to applying for a personal loan, since the higher your salary, the lower the rate of interest you’ll receive. A high monthly salary indicates that you can repay your loan in a timely manner, which is an important consideration for a bank to consider. Also, a high income will help improve your credit rating and help you qualify for a lower interest rate.